Buying Property in Thailand

Buying Property in Thailand can be a complicated process. Not only are the laws difficult to navigate but there are also several scams that could lead you to losing your money. We strongly advise speaking to a professional before making any decisions.

Buying a Condo in Thailand

One of the more clear and established real estate laws in Thailand in Condo ownership.

Foreigners can own up to 49% of the total area of a condominium project. This rule applies to the total area of all units within the project, not just the individual unit.

This means that foreigners can own 100% of their unit.

Buying a house in Thailand

Purchasing residential property in Thailand presents complexities for foreigners, primarily due to the legal restriction that prohibits non-Thais from owning land. This regulation aims to maintain housing affordability for local residents, yet it remains a significant challenge for foreigners who have lived and worked in Thailand for extended periods. Although there are alternative methods available for those seeking to acquire a house rather than a condominium, each option carries its own set of risks and legal considerations. Therefore, it is essential for prospective buyers to seek advice from qualified professionals in the real estate sector to navigate these intricacies effectively.

1. Leasehold: Foreigners can lease land for up to 30 years, with options to renew, though lease terms can vary based on negotiation and agreement with the landowner. Some of the property developers now offer this as an option, so speak to them about your options. It should also be noted that at the time of writing there is discussion about raising the contract to up to 99 years.

2. Thai Company Ownership: A foreigner can control a Thai company that owns land, but the company must be majority-owned by Thai nationals (at least 51% Thai ownership). While this method is a popular choice for foreigners it can be complex and involve legal and operational considerations, e.g. business operational costs, accounting and risk of liquidation of company assets.

3. Investment Promotion: In certain cases, the Board of Investment (BOI) can grant foreign investors the right to own land if they meet specific criteria and invest a significant amount of money.

4. Through a spouse: Foreigners can own land through marriage, however they have to give up their rights to the property to the spouse. This is an easy route for foreigners, however the foreigner is at high risk of losing their property should the marriage end in divorce.

Tax Obligations

When purchasing property, foreigners must be aware of various taxes and fees, including:

- Transfer Fee: Typically 2% of the appraised value of the property.

- Stamp Duty: 0.5% of the sale price or the appraised value, whichever is higher.

- Specific Business Tax (SBT): If selling within five years of purchase, this is 3.3% of the sale price or the appraised value, whichever is higher.

- Withholding Tax: For individual sellers, this is based on the progressive tax rate applicable to the gain from the sale.

Beware of Scams

- Rights Risks: As a foreigner you do not have the same rights as you do in your homeland. Laws can change at any time so there is always risk.

- Fake Listings: Fraudsters may create fake listings for properties that don’t exist or aren’t for sale. These listings often look convincing and may be advertised at attractive prices.

- Phantom Listings: Scammers might sell land they don’t own or that is not legally available for sale. They may use forged documents or false claims about land ownership.

- Fake Title Deeds: Fraudsters may produce counterfeit title deeds to sell land. These fake documents may look authentic but do not reflect the true ownership status of the property.

- Leasehold Scams: Some scams involve offering long-term lease agreements with the promise of eventual ownership. These schemes can be fraudulent if the lease terms are manipulated or if there are hidden clauses that disadvantage the lessee.

- Nominee Schemes: In these schemes, a foreign buyer is encouraged to use a Thai “nominee” to hold the land on their behalf. While this might seem like a workaround to Thai land ownership laws, it is illegal and can result in legal disputes or loss of the property.

- Fake Real Estate Agents: Scammers may pose as real estate agents or brokers, charging fees for services that they do not provide. They may also fabricate deals and disappear once they’ve received payment.

- Fradulent Development Projects: Scammers might sell land in supposed development projects that do not exist or are not authorized. These projects often promise high returns or exclusive deals.

- Land Measurements: Some scammers will sell land with a bigger size on the deed than on the real plot.

Tips to Avoid Scams

Verify Ownership: Always check the property title and ownership records with the Land Department to confirm that the seller is the legitimate owner.

Hire a Reputable Lawyer: Engage a qualified real estate lawyer who is familiar with Thai property laws to review all documents and transactions.

Use a Trusted Agent: Work with established and reputable real estate agents or agencies who have a solid track record and can provide references.

Conduct Due Diligence: Thoroughly investigate the property, including any development plans or zoning restrictions, and verify the legitimacy of all documents.

Avoid Nominee Schemes: Adhere to legal methods of property ownership and avoid arrangements that involve nominee structures, which can be risky and legally problematic.

Seek Professional Advice: Do not be tempted by pressure and promotions, rushing you to invest. Take your time to do your due diligence, even if the offer is too good to be true.

Other Helpful Resources

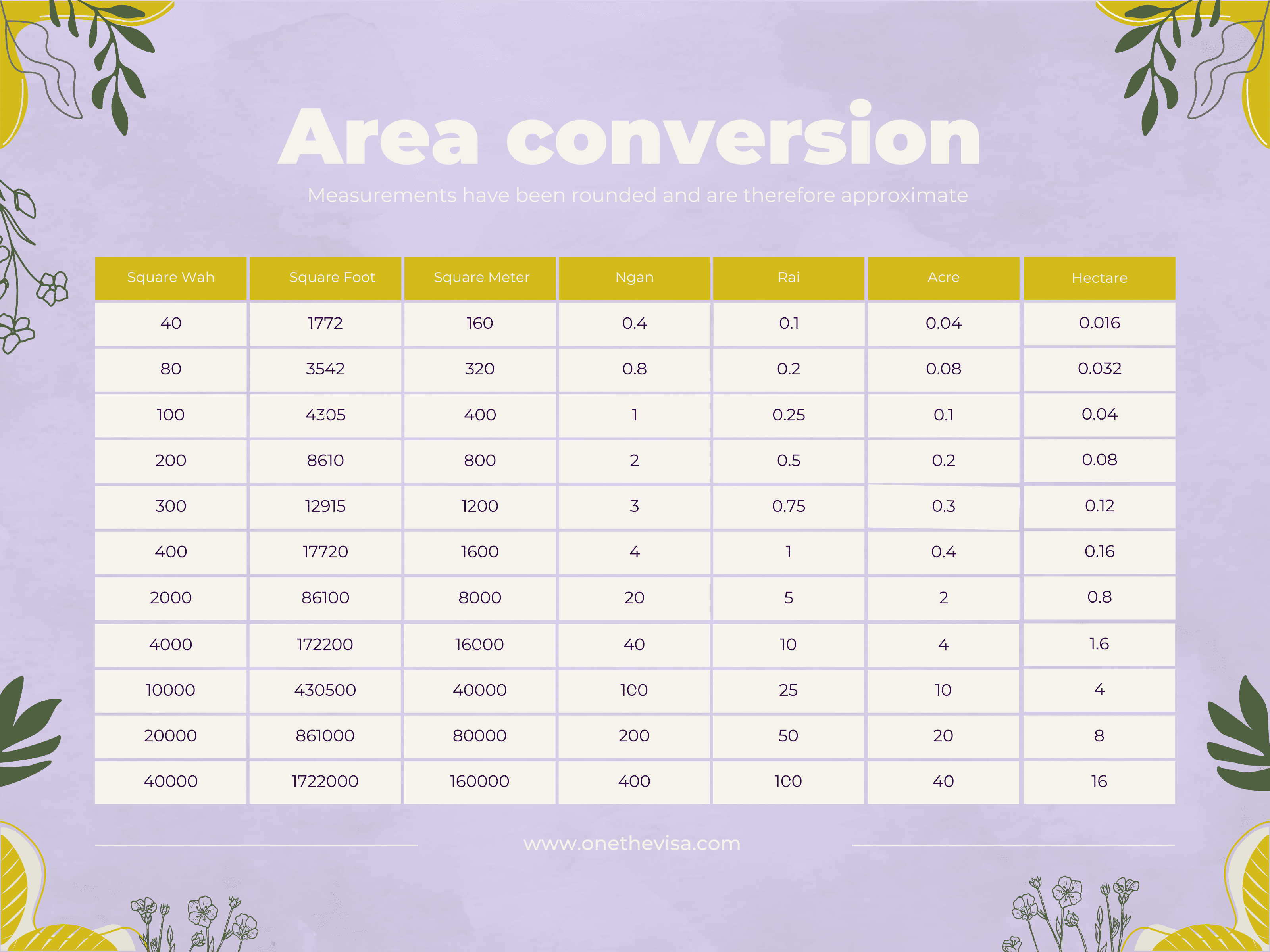

Thai generally measures in Rai, Wah and Ngan. This can be confusing so we have created a downloadable file to help you convert measurements.